Property Tax Rate In Brunswick County Nc . The ordinance and accompanying stormwater management. Search our property and tax information or download our forms and. Our brunswick county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. Property subject to taxation must be assessed at 100% of appraised value. See brunswick county tax rates. The brunswick county ad valorem (property) tax rate for fiscal year 2025 (july 1, 2024 to june 30, 2025) is 0.3420 (34.20 cents per $100 value). The median property tax (also known as real estate tax) in brunswick county is $933.00 per year, based on a median home value of. Revaluations are effective january 1 of year shown.

from ar.inspiredpencil.com

The brunswick county ad valorem (property) tax rate for fiscal year 2025 (july 1, 2024 to june 30, 2025) is 0.3420 (34.20 cents per $100 value). Search our property and tax information or download our forms and. Revaluations are effective january 1 of year shown. Our brunswick county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. The median property tax (also known as real estate tax) in brunswick county is $933.00 per year, based on a median home value of. The ordinance and accompanying stormwater management. Property subject to taxation must be assessed at 100% of appraised value. See brunswick county tax rates.

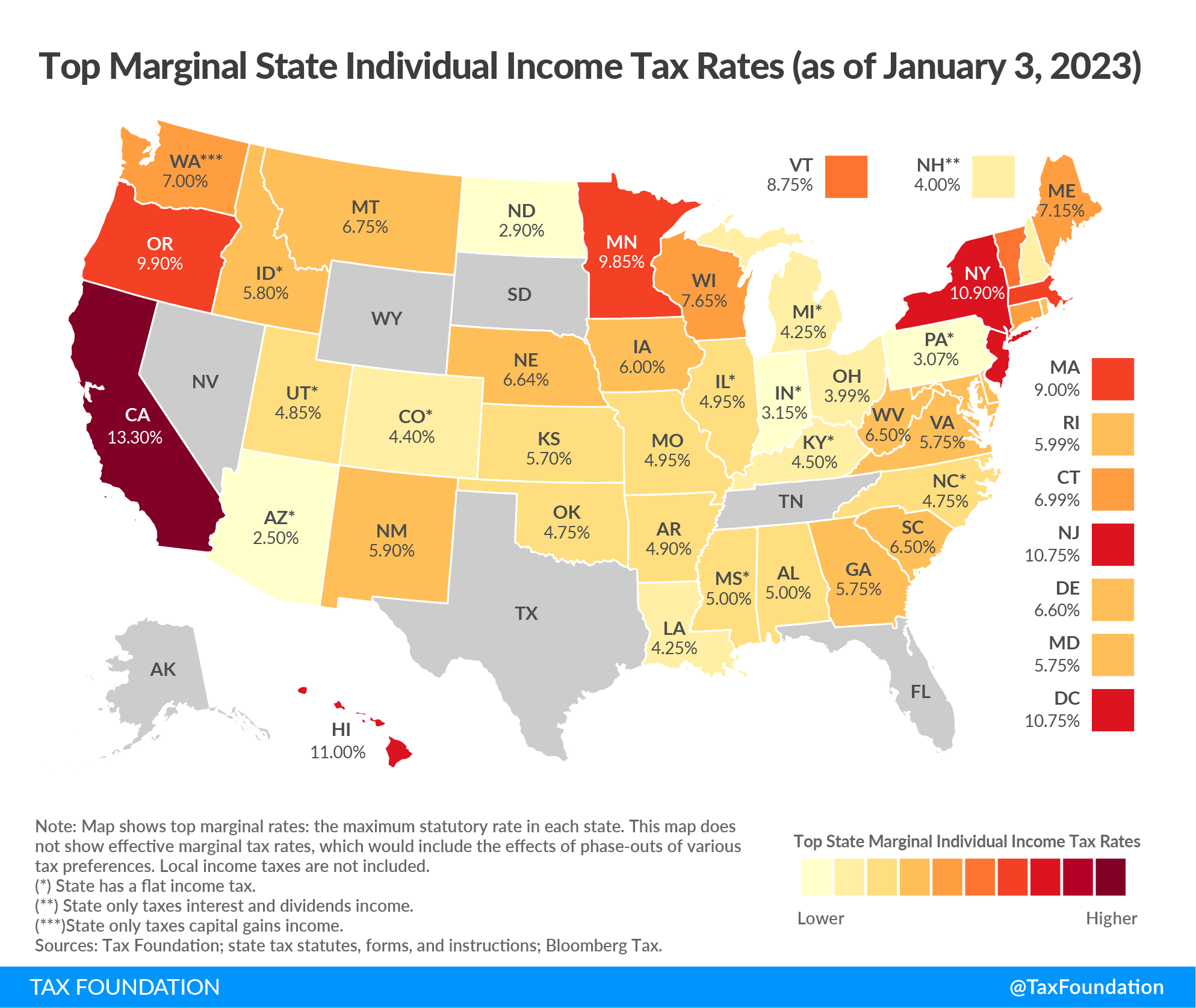

Individual States

Property Tax Rate In Brunswick County Nc The brunswick county ad valorem (property) tax rate for fiscal year 2025 (july 1, 2024 to june 30, 2025) is 0.3420 (34.20 cents per $100 value). The brunswick county ad valorem (property) tax rate for fiscal year 2025 (july 1, 2024 to june 30, 2025) is 0.3420 (34.20 cents per $100 value). Search our property and tax information or download our forms and. Revaluations are effective january 1 of year shown. The median property tax (also known as real estate tax) in brunswick county is $933.00 per year, based on a median home value of. The ordinance and accompanying stormwater management. Property subject to taxation must be assessed at 100% of appraised value. Our brunswick county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. See brunswick county tax rates.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment Property Tax Rate In Brunswick County Nc Search our property and tax information or download our forms and. The brunswick county ad valorem (property) tax rate for fiscal year 2025 (july 1, 2024 to june 30, 2025) is 0.3420 (34.20 cents per $100 value). The ordinance and accompanying stormwater management. See brunswick county tax rates. The median property tax (also known as real estate tax) in brunswick. Property Tax Rate In Brunswick County Nc.

From activerain.com

2019 Property Tax Rates Mecklenburg And Union Counties Property Tax Rate In Brunswick County Nc Property subject to taxation must be assessed at 100% of appraised value. The brunswick county ad valorem (property) tax rate for fiscal year 2025 (july 1, 2024 to june 30, 2025) is 0.3420 (34.20 cents per $100 value). Search our property and tax information or download our forms and. The ordinance and accompanying stormwater management. The median property tax (also. Property Tax Rate In Brunswick County Nc.

From www.fox21online.com

Duluth's Council Approves 8.9 Increase In Property Tax Levy Property Tax Rate In Brunswick County Nc Search our property and tax information or download our forms and. Revaluations are effective january 1 of year shown. The brunswick county ad valorem (property) tax rate for fiscal year 2025 (july 1, 2024 to june 30, 2025) is 0.3420 (34.20 cents per $100 value). Property subject to taxation must be assessed at 100% of appraised value. The median property. Property Tax Rate In Brunswick County Nc.

From fill.io

Fill Free fillable forms Brunswick County Property Tax Rate In Brunswick County Nc Property subject to taxation must be assessed at 100% of appraised value. See brunswick county tax rates. Revaluations are effective january 1 of year shown. Search our property and tax information or download our forms and. The brunswick county ad valorem (property) tax rate for fiscal year 2025 (july 1, 2024 to june 30, 2025) is 0.3420 (34.20 cents per. Property Tax Rate In Brunswick County Nc.

From propertywalls.blogspot.com

Brunswick County Nc Property Tax Rate Property Walls Property Tax Rate In Brunswick County Nc The brunswick county ad valorem (property) tax rate for fiscal year 2025 (july 1, 2024 to june 30, 2025) is 0.3420 (34.20 cents per $100 value). See brunswick county tax rates. Our brunswick county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. The ordinance and accompanying stormwater management. Revaluations. Property Tax Rate In Brunswick County Nc.

From othiliaolesya.pages.dev

Brunswick County Nc Gis Vicky Jermaine Property Tax Rate In Brunswick County Nc The brunswick county ad valorem (property) tax rate for fiscal year 2025 (july 1, 2024 to june 30, 2025) is 0.3420 (34.20 cents per $100 value). Property subject to taxation must be assessed at 100% of appraised value. The median property tax (also known as real estate tax) in brunswick county is $933.00 per year, based on a median home. Property Tax Rate In Brunswick County Nc.

From www.uslandgrid.com

BrunswickCounty Tax Parcels / Ownership Property Tax Rate In Brunswick County Nc The median property tax (also known as real estate tax) in brunswick county is $933.00 per year, based on a median home value of. See brunswick county tax rates. The ordinance and accompanying stormwater management. Search our property and tax information or download our forms and. Our brunswick county property tax calculator can estimate your property taxes based on similar. Property Tax Rate In Brunswick County Nc.

From northbrunswicknj.gov

Maps Township of North Brunswick Property Tax Rate In Brunswick County Nc Our brunswick county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. The brunswick county ad valorem (property) tax rate for fiscal year 2025 (july 1, 2024 to june 30, 2025) is 0.3420 (34.20 cents per $100 value). Search our property and tax information or download our forms and. Revaluations. Property Tax Rate In Brunswick County Nc.

From antheyeleonora.pages.dev

Texas Sales Tax Free Weekend 2024 Tara Zulema Property Tax Rate In Brunswick County Nc The brunswick county ad valorem (property) tax rate for fiscal year 2025 (july 1, 2024 to june 30, 2025) is 0.3420 (34.20 cents per $100 value). Revaluations are effective january 1 of year shown. Property subject to taxation must be assessed at 100% of appraised value. Search our property and tax information or download our forms and. The ordinance and. Property Tax Rate In Brunswick County Nc.

From taxfoundation.org

Combined State and Federal Corporate Tax Rates in 2022 Property Tax Rate In Brunswick County Nc The brunswick county ad valorem (property) tax rate for fiscal year 2025 (july 1, 2024 to june 30, 2025) is 0.3420 (34.20 cents per $100 value). The median property tax (also known as real estate tax) in brunswick county is $933.00 per year, based on a median home value of. See brunswick county tax rates. Property subject to taxation must. Property Tax Rate In Brunswick County Nc.

From greatsenioryears.com

States With No Property Tax for Seniors Greatsenioryears Property Tax Rate In Brunswick County Nc The brunswick county ad valorem (property) tax rate for fiscal year 2025 (july 1, 2024 to june 30, 2025) is 0.3420 (34.20 cents per $100 value). The ordinance and accompanying stormwater management. Search our property and tax information or download our forms and. Revaluations are effective january 1 of year shown. The median property tax (also known as real estate. Property Tax Rate In Brunswick County Nc.

From propertyownersalliance.org

How High Are Property Taxes in Your State? American Property Owners Property Tax Rate In Brunswick County Nc See brunswick county tax rates. The median property tax (also known as real estate tax) in brunswick county is $933.00 per year, based on a median home value of. Property subject to taxation must be assessed at 100% of appraised value. The ordinance and accompanying stormwater management. Our brunswick county property tax calculator can estimate your property taxes based on. Property Tax Rate In Brunswick County Nc.

From www.mof.gov.sg

MOF Press Releases Property Tax Rate In Brunswick County Nc Revaluations are effective january 1 of year shown. The median property tax (also known as real estate tax) in brunswick county is $933.00 per year, based on a median home value of. Our brunswick county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. See brunswick county tax rates. The. Property Tax Rate In Brunswick County Nc.

From www.strashny.com

State and Local Sales Tax Rates, Midyear 2021 Laura Strashny Property Tax Rate In Brunswick County Nc Search our property and tax information or download our forms and. The brunswick county ad valorem (property) tax rate for fiscal year 2025 (july 1, 2024 to june 30, 2025) is 0.3420 (34.20 cents per $100 value). Revaluations are effective january 1 of year shown. The median property tax (also known as real estate tax) in brunswick county is $933.00. Property Tax Rate In Brunswick County Nc.

From www.primecorporateservices.com

Comparing Property Tax Rates State By State Prime Corporate Services Property Tax Rate In Brunswick County Nc Property subject to taxation must be assessed at 100% of appraised value. The brunswick county ad valorem (property) tax rate for fiscal year 2025 (july 1, 2024 to june 30, 2025) is 0.3420 (34.20 cents per $100 value). Revaluations are effective january 1 of year shown. The median property tax (also known as real estate tax) in brunswick county is. Property Tax Rate In Brunswick County Nc.

From dailysignal.com

How High Are Property Taxes in Your State? Property Tax Rate In Brunswick County Nc Search our property and tax information or download our forms and. Property subject to taxation must be assessed at 100% of appraised value. The ordinance and accompanying stormwater management. The median property tax (also known as real estate tax) in brunswick county is $933.00 per year, based on a median home value of. See brunswick county tax rates. Revaluations are. Property Tax Rate In Brunswick County Nc.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Eye On Housing Property Tax Rate In Brunswick County Nc Revaluations are effective january 1 of year shown. The ordinance and accompanying stormwater management. The median property tax (also known as real estate tax) in brunswick county is $933.00 per year, based on a median home value of. Property subject to taxation must be assessed at 100% of appraised value. Search our property and tax information or download our forms. Property Tax Rate In Brunswick County Nc.

From www.newsncr.com

These States Have the Highest Property Tax Rates Property Tax Rate In Brunswick County Nc Our brunswick county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. See brunswick county tax rates. The brunswick county ad valorem (property) tax rate for fiscal year 2025 (july 1, 2024 to june 30, 2025) is 0.3420 (34.20 cents per $100 value). Revaluations are effective january 1 of year. Property Tax Rate In Brunswick County Nc.